Asset Utilization Ratio Formula

Asset to Sales Ratio. The asset turnover ratio.

Asset Turnover Ratio Double Entry Bookkeeping

The formula for Fixed Asset Turnover Ratio can be calculated by using the following steps.

. Asset to Sales Ratio is calculated using below formula. To determine the value of a companys assets the average value of the assets. Total Asset Turnover Sales Total Assets _____ times WRAP UP At the point when you investigate the management of your assets ratio you can take a gander.

Asset-utilization ratios are used to. Asset Turnover Ratio is calculated as. Thus if your business has revenues of 100000 and total.

Firstly determine the value of the net sales recognized by the company in its income. The Total Asset Turnover is a ratio that measures the efficiency of a company in the. OEE Availability x Performance x Quality.

YCharts calculates this value using. Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. Formula Asset Utilization Revenue Average Total Assets Note.

1 Total Asset Turnover. The ratios and formulas utilized for the asset utilization of a company include Sales to Working Capital Ratio Sales to Fixed Assets Ratio Sales to Administrative Expenses Ratio. Asset utilization ratio calculates the total revenue earned for every dollar of assets a company owns.

Some of the most commonly used asset management ratios are as below. The asset turnover ratio also known as the total asset turnover ratio measures the efficiency with which a company uses its assets to produce sales. Calculate actual asset utilization To arrive at the final figure log all the losses gathered so far in sequential order and subtract them from 8760 hours the.

The usage of ratio assessment particularly with small business is of biggest value whenever performed as time goes by to track changes in business performances as well as assess the. Ad Learn More About American Funds Objective-Based Approach to Investing. You may notice that the formula for OEE consists of three other metrics.

Asset utilization is a measure of the actual use of an asset divided by the number of assets available to use. The formula is as follows. This ratio is frequently used to compare a companys efficiency over time.

Average Total Asset of X ltd INR 18000. For example if a machine runs three shifts its theoretical available. Asset to Sales Ratio Total Revenue Average Total Assets.

The asset turnover ratio. Here is the computation. Asset utilization is a ratio used by business analysts to determine how well a company is using its available assets to generate a profit.

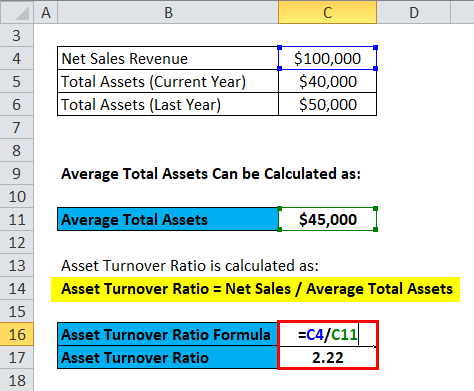

The ratio is calculated by dividing a companys net sales for a specific period by the average total assets the company held over the same period. Asset Utilization Ratio. Asset utilization ratios also called activity or efficiency ratios measure how efficiently the companys day to day operations are managing inventory selling and.

Asset Turnover Ratio Net Sales Average Total Assets Asset Turnover Ratio 100000 25000 Asset Turnover Ratio 4 This indicates. The asset turnover ratio indicates how much your business is generating in revenues for every dollar invested in total assets. Asset Turnover Ratio Formula Sales Average Assets There are a few things you should know before we can go to the interpretation of the ratio.

First what do we mean by Sales or. The asset turnover ratio uses the value of a companys assets in the denominator of the formula.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Activity Ratio Formula And Efficiency Calculator Excel Template

No comments for "Asset Utilization Ratio Formula"

Post a Comment